- Region

- Vega baja

- Marina Alta

- Marina Baixa

- Alicante

- Baix Vinalopo

- Alto & Mitja Vinalopo

-

ALL TOWNS

- ALICANTE TOWNS

- Albatera

- Alfaz Del Pi

- Alicante City

- Alcoy

- Almoradi

- Benitatxell

- Bigastro

- Benferri

- Benidorm

- Calosa de Segura

- Calpe

- Catral

- Costa Blanca

- Cox

- Daya Vieja

- Denia

- Elche

- Elda

- Granja de Rocamora

- Guardamar del Segura

- Jacarilla

- Los Montesinos

- Orihuela

- Pedreguer

- Pilar de Horadada

- Playa Flamenca

- Quesada

- Rafal

- Redovan

- Rojales

- San Isidro

- Torrevieja

- Comunidad Valenciana

Legal and financial expat assistance in Spain with Thy Will Be Done

Understanding the importance of wills and estate planning for foreigners in Spain

Protection options for expats

1. A Spanish Will written with a Brussels iv (EU succession 2012/650) clause to ensure that your Spanish estate will not be subject to Spanish forced heirship rules but will be able to be left to who you wish using the law of England and Wales or whichever legal jurisdiction within the UK you prefer (remembering that the law of England and Wales is the most accommodating and flexible).

2. An usufructo clause within your Spanish Will to ensure that if you are married or cohabiting and own a property solely yourself or together with your spouse/partner that if you die first and your surviving spouse/partner marries after your death or goes into care that your half of the property cannot be lost to the new spouse or their family or be taken to pay for the care fees of your spouse/partner after your death and will be secure for the beneficiaries specified within your Spanish Will, while at the same time protecting your spouse/ partner from being forced out of the property by your beneficiaries.

3. If none of your beneficiaries speak Spanish it is advisable to elect us as your executors for your Spanish estate so that we can liaise in English with each of them and organise the NIE number and Power of Attorney that they will require in order to inherit their share.

4. Priority Client Cover is highly recommended for anyone electing us as their executors as it will reduce probate fees down by 1/3 as well as providing a whole host of other benefits which can be found on our leaflet regarding this or by going to https://thywill.es/priorityclient-cover-spain.

5. A Will legal in England and Wales (or Scotland, Northern Ireland, The Isle of Man or Jersey and Guernsey), specifying who you wish to inherit your UK based estate (bank accounts/ investments/property).

6. If you are having a Will drafted for assets in England and Wales, a Nil Rate Band Trust and, if you own a property in England and Wales, and are leaving that property to a spouse or children, a Residential Nil Rate Band Trust also.

If your estate goes over the basic Nil Rate Band allowance of £325k or the £500k combined Nil Rate and Residential Nil Rate Band allowance (where a property is involved) then an immediate Post Death Interest Trust should also be included to ensure that all your monetary assets are protected for your partner to use after your death and won’t be in their own estate and be able to be taken into consideration by the Local Authority if they go into care or be lost from the family should they remarry and subsequently die or divorce or go bankrupt. After the death of your spouse (if you have died first) these Trusts go on to protect your children’s inheritance so it can’t be:

If you would like to have a chat give the reception team a call on the number below and they will book you in a convenient time slot to have your FREE telephone consultation:

If you would like to have a chat give the reception team a call on the number below and they will book you in a convenient time slot to have your FREE telephone consultation:staff.inc.ali

Mobile: 0800 668 11 64 (UK)

Helping British expats protect their assets in the UK and Spain

If you're looking for expert, affordable legal and financial guidance for planning your future and protecting your assets both in the UK and Spain, Thy Will Be Done offers a full range of estate planning and advisory services you can rely on.

If you're looking for expert, affordable legal and financial guidance for planning your future and protecting your assets both in the UK and Spain, Thy Will Be Done offers a full range of estate planning and advisory services you can rely on.Services include:

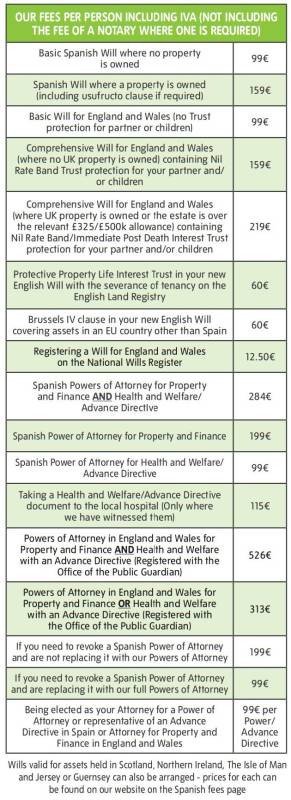

- UK and Spanish wills, including low-cost wills for parents with children under 18

- Lasting Powers of Attorney

- Property Trusts

- Probate services with low fees

- Pre-paid funeral plans in Spain with interest-free monthly payments

- Estate planning and inheritance advice

- Life insurance, pensions, investments, mortgages and equity release

“We truly believe that where there’s a Will – there’s a Way.”

Contact details

- Telephone: 0800 668 11 64 (UK) / 0034 865 756 058 (Spain)

- Email: info@thywill.es

- Website: www.thywill.es